Wills, Testamentary Trusts & Estate Planning

WILLS, TESTAMENTARY TRUSTS & ESTATE PLANNING

At Gamble Law, we understand that making a will is a significant step in ensuring your wishes are honoured after you’ve passed.

Our dedicated team is here to assist you through every aspect of the will-making process. We have extensive experience preparing wills for individuals from all walks of life and pride ourselves on tailoring each document to your unique needs, explained in a clear and straightforward manner.

Whether you’re starting your estate planning journey or revisiting existing documents, we offer tailored solutions to protect your assets and ensure your wishes are carried out.

Why Choose Gamble Law for Your Will-Making Needs?

A will is one of the most important documents you can create to ensure that your estate is distributed according to your wishes. Our experienced lawyers will guide you through the process, addressing everything from asset distribution to guardianship of minor children. We make sure your will is clear, legally sound, and customised to your unique circumstances.

Our will-making procedure takes into account your personal circumstances, offering comprehensive advice on various matters related to your estate planning, including:

- Testamentary trusts

- Interests in companies or trusts

- Superannuation death benefits and their implications

- Understanding the potential for Family

- Provision Claims from disgruntled beneficiaries

- Appointing guardians for minor children

- Strategies to ensure your wishes are upheld after your passing

- Managing digital assets and determining who will control them

Testamentary Trusts

A testamentary trust is established through your will and takes effect upon your death, providing an additional layer of security and flexibility for your loved ones.

Whether you want to protect assets for minor children, manage wealth for beneficiaries with special needs or provide general asset protection and taxation benefits, a testamentary trust can offer flexibility and control. We work with you to structure a trust that aligns with your goals.

Refer to our article Navigating the Benefits of Testamentary Trust Wills with Gamble Law for further information.

Comprehensive Estate Planning

Estate planning is about more than just creating a will. We help you navigate the complexities of trusts, powers of attorney, healthcare directives, and tax strategies to ensure your estate is managed efficiently and your loved ones are cared for. Our goal is to create a comprehensive plan that reflects your values and provides long-term security.

Contact Gamble Law & Estate Planning to start the conversation about your future today.

What is a Testamentary Trust Will?

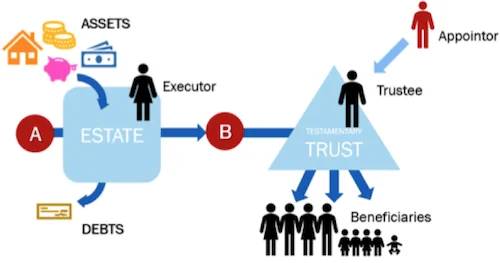

A Testamentary Trust Will can be explained using the below diagram.

“A” signalises the death of the Will maker. The “Estate” is administered normally and would include obtaining a grant of Probate and calling in the assets of the estate.

“B” shows the transfer of the assets of the estate to the Testamentary Trust. Instead of the assets being transferred to the beneficiary in their personal capacity the assets are transferred to the Testamentary Trust established by the Will.

From this point, normal trust principles apply. These are as follows:

- There is a Trustee who controls the trust and is responsible for day to day decisions;

- There are Beneficiaries of the trust which includes the Primary Beneficiary and remoter descendants, who can all benefit from the trust;

- Trust property which must be made up of assets of the deceased person’s estate; and

- The Appointor who has the power to choose and remove the Trustees.

One of the most important benefits of a testamentary trust is the asset protection that it provides to the beneficiaries of the will. There are two circumstances where this is most relevant:

RELATIONSHIP BREAKDOWN

It is a startlingly fact that one in three marriages end in divorce (according to the ABS) and these figures don’t take into ac-+count the breakdown of de facto relationships. With the heightened risk of relationship breakdowns comes the increased focus on preserving family assets. If a Will maker has a simple will, a beneficiary will receive their inheritance in their personal capacity. After a few years of marriage, these inherited assets are generally intermingled with the matrimonial assets. If the relationship was to end, the Family Court may make orders regarding the division of property, including those assets that have been inherited. In short, this may mean that your nominated beneficiary’s inheritance could end up in the hands of their spouse. A Testamentary Trust avoids the above circumstance in that the nominated beneficiary is generally not the legal owner of the assets held by the trust. This means that in the event of the beneficiary going through a relationship breakdown, the Family Court is less likely to make an award in favour of the beneficiary’s spouse in relation to the inherited assets held by the testamentary trust. The Family Court’s view on a Testamentary Trust is that it is a “financial resource” of a party as opposed to a “divisible asset”. This means that the Testamentary Trust will not form part of the matrimonial pool for division and, more importantly, will remain the property of your nominated beneficiary. Careful drafting of the Testamentary Trust will ensure protection if these circumstances arise.

BANKRUPTCY

The other circumstance where a Testamentary Trust Will has significant benefits is where a beneficiary is in a high risk occupation or has a track record of being incapable of managing their own financial affairs. Again, if the beneficiary received an inheritance in their own personal capacity, if they were made bankrupt any assets owned would vest in their trustee in bankruptcy. A Testamentary Trust however is not an asset of the bankrupt beneficiary which means the trustee in bankruptcy has great difficulty deeming the assets of the Testamentary Trust as property of the bankrupt.

A Testamentary Trust allows income from the trust to be distributed in a tax effective manner. As opposed to the income from the trust being distributed solely to your nominated beneficiary, the trust allows the income to be distributed to a wider class of beneficiaries such as your nominated beneficiaries’ children or grandchildren. The trust also allows any capital gains made by the trust to be split between a number of beneficiaries, including those individuals on the lowest marginal tax rates, therefore reducing the tax payable on investments.

If you have assets that would mean each of your beneficiaries would receive in excess of $350,000, it is something that should be considered by you. This amount may be even less in circumstances where your child has an addiction, is a spendthrift, has been in and out of unstable relationships or in a high-risk occupation.

ENDURING POWER OF ATTORNEY LAWYERS IN WOLLONGONG

An Enduring Power of Attorney is an estate-planning mechanism that relates to financial decisions.

- Enduring means that the power of attorney continues to be effective even if you no longer have capacity to make these decisions;

- Power relates to the powers that are granted to your attorney and the financial decisions you allow them to make on your behalf; and

- Attorney refers to the person who you appoint to make these financial decisions. Generally people appoint their spouse and have a child or friend who live nearby as a backup.

In essence, you give your attorney the ability to make financial decisions on your behalf. Generally, your attorney is not authorised to spend your money on themselves.

APPOINTMENT OF ENDURING GUARDIAN

An Appointment of Enduring Guardian allows your guardian to make non-financial decisions on your behalf when you are no longer able to do so yourself.

These documents are becoming increasingly common, as many institutions such as hospitals and nursing homes will only allow your guardian to make decisions on your behalf if you are no longer able to yourself. Items that can be covered by your guardian include:

- Where you live

- What health care you receive

- What other kinds of personal services you receive

Get in touch

"*" indicates required fields

Meet the Team

Andrew Gamble

Partner

Experience

Andrew is a Partner at Gamble Law and has worked in the firm for over 10 years.

Andrew is a passionate wills, estates and property lawyer and has wide-ranging experience in all areas of estate litigation including family provision claims, probate disputes and disputes concerning trusts.

Andrew also has expertise in complex wills and estate planning, conveyancing and property law.

Andrew takes great pride in assisting his clients in a wide range of areas.

Area of Expertise

- Estate Litigation

- Complex Wills

- Probate &

- Letters of Administration

- Conveyancing and Property Transactions

- Probate

- Powers of Attorney and Enduring Guardianships

Qualifications

- Bachelor of Laws, University of Wollongong

- Bachelor of Commerce, University of Wollongong

- Master of Applied Law in Wills and Estates, College of Law

- Trust and Estate Practitioner (Member of STEP)

Outside of work Andrew likes keeping fit by running and surfing as well as spending time with his fiancé Mia.

Cristian Apolloni

Partner

Experience

Cristian joined Gamble Law & Estate Planning as a Partner in January 2024 and leads the firm’s Commercial and Corporate division. He has returned to his beloved hometown of Wollongong after more than six years in Melbourne working at a nationally recognised mid-tier law firm.

Cristian takes a pragmatic and commercial approach when advising his clients, understanding that his value as a lawyer extends beyond merely providing expert legal advice. He is a true “people person” and finds fulfilment in watching his clients grow and succeed in business.

Cristian has wide-ranging experience across the spectrum of commercial and corporate law and has had the pleasure of working with clients in all manner of industries. Cristian also advises on property law and conveyancing transactions and commercial, industrial and retail leasing matters.

Area of Expertise

- Mergers and Acquisitions

- Business Sales and Purchases

- Shareholder Agreements

- Joint Venture Arrangements

- Business Structuring and Restructuring

- Commercial Contracts

- Commercial and Retail Leasing

- Business Succession

- Corporate Governance and Advisory

- Trademarks and IP protection

- Privacy Policies and Terms of Use

- Property Transactions

Qualifications

- Master of Laws (Commercial & Corporate), Monash University

- Bachelor of Laws (Hons), University of Wollongong

- Bachelor of Economics and Finance (Distinction), University of Wollongong

- Graduate Diploma of Legal Practice, College of Law

Outside of work, Cristian is a family man who enjoys spending his weekends outdoors whether that’s at the beach, on the golf course or running the Blue Mile.

Jack Adams

Solicitor

Experience

Jack was born and raised in the Illawarra graduating from the University of Wollongong in December 2019 with a Bachelor of Laws and Commerce (Finance). Jack completed his Practical Legal training at the College of Law and was admitted as a lawyer of the Supreme Court of New South Wales in May 2020. Jack joined Gamble Law & Estate planning as a Solicitor in October 2022.

Jack predominately practices in the areas of Wills and Estates, Conveyancing and Property Transactions and Family Law. In the area of Wills and Estates, Jack provides advice to clients who need guidance with estate planning, estate disputes and estate administration. In the area of Family Law, Jack has experience in both property and parenting matters.

Jack prides himself on being approachable, empathetic, and caring, during what can be a very stressful time for clients.

Outside of work Jack enjoys his sport, playing hockey and tennis locally. He is a keen follower of the Canterbury Bulldogs NRL team.

Area of Expertise

- Estate Planning including Wills, Powers of Attorney and Enduring Guardianships

- Probate

- Estate Disputes

- Conveyancing and Property Transactions

- Family Law

- Business Sales and Purchases

- Commercial Law

Qualifications

- Bachelor of Laws, University of Wollongong

- Bachelor of Commerce (Finance), University of Wollongong

Michael Gamble

Consultant

Experience

Michael has been practicing as a solicitor in Wollongong since 1978. In addition to his legal qualifications, he has a Diploma of Financial Planning and is a member of the internationally recognised Society of Trust and Estate Practitioners.

Why Choose Gamble Law

Ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa.

Insert Key Selling Point

Ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. CumIpsum dolor sit amet,

Insert Key Selling Point

Ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. CumIpsum dolor sit amet,

Insert Key Selling Point

Ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. CumIpsum dolor sit amet,

What our clients say

See for yourself some of the feedback we’ve received from our valued clients following their experience with us

Service, professionalism and output is 2nd to none. Very happy to recommend their firm.

Latest News

Keep up to date with what’s happening at Gamble Law and your community

Understanding the Probate Process in New South Wales

When someone passes away in New South Wales (NSW) with a valid will, the appointed executor(s) often have the responsibility of applying for a grant

Gamble Law acquires Warren Saunders’ Safe Custody Documents

Gamble Law & Estate Planning is pleased to announce that it has acquired the safe custody documents previously held by Warren Saunders, solicitor. This acquisition

The Essential Role of an Enduring Guardian in Estate Planning

As we journey through life, it’s crucial to prepare for unforeseen circumstances that might prevent us from making our own decisions. One significant aspect of

Navigating the Benefits of Testamentary Trust Wills with Gamble Law

The Rise of Testamentary Trust Wills In recent years, Testamentary Trust Wills have gained popularity as an effective way for individuals to pass on their

Law and Estate Planning a family affair as new business owners take over Gamble Law & Estate Planning

Andrew Gamble has been tapped to lead Wollongong boutique firm Gamble Law & Estate Planning, succeeding his father Michael. Andrew will be sharing the mantle

Who Can Make A Claim On Your Estate?

You have worked hard your whole life to acquire your wealth. When making your Will and Last Testament you hope that your wishes of where

Other legal practise areas

At Gamble Law, our lawyers have the expertise and experience to meet your legal needs in the following areas:

Criminal Cases

Ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. CumIpsum dolor sit amet,

Drug Offense

Ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. CumIpsum dolor sit amet,

Capital Market

Ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. CumIpsum dolor sit amet,